Working from the comfort of your own home offers a unique set of perks, but it also comes with responsibilities, particularly in the realm of managing finances and navigating the intricate landscape of taxes. Whether you’re a freelance writer, a graphic designer, or a virtual assistant, understanding how to handle your money and managing finances and taxes is crucial for long-term success. In this article, we’ll explore practical tips and insights to help you navigate the financial maze of making money from home.

Key Takeaway for Managing Finances and Taxes

Before we delve into the details, here’s a quick summary of the key points we’ll be covering:

- Track Your Income and Expenses: Keep a meticulous record of what you earn and spend.

- Create a Dedicated Workspace: Establishing a designated work area can have tax benefits.

- Understand Self-Employment Taxes: Grasp the nuances of self-employment taxes to avoid surprises.

- Embrace Digital Tools: Leverage technology to streamline your financial processes.

- Save for Taxes Regularly: Set aside a portion of your income to cover tax obligations.

- Explore Deductions: Identify potential deductions to minimize your taxable income.

- Consult a Tax Professional: Seek professional advice to ensure compliance and maximize benefits.

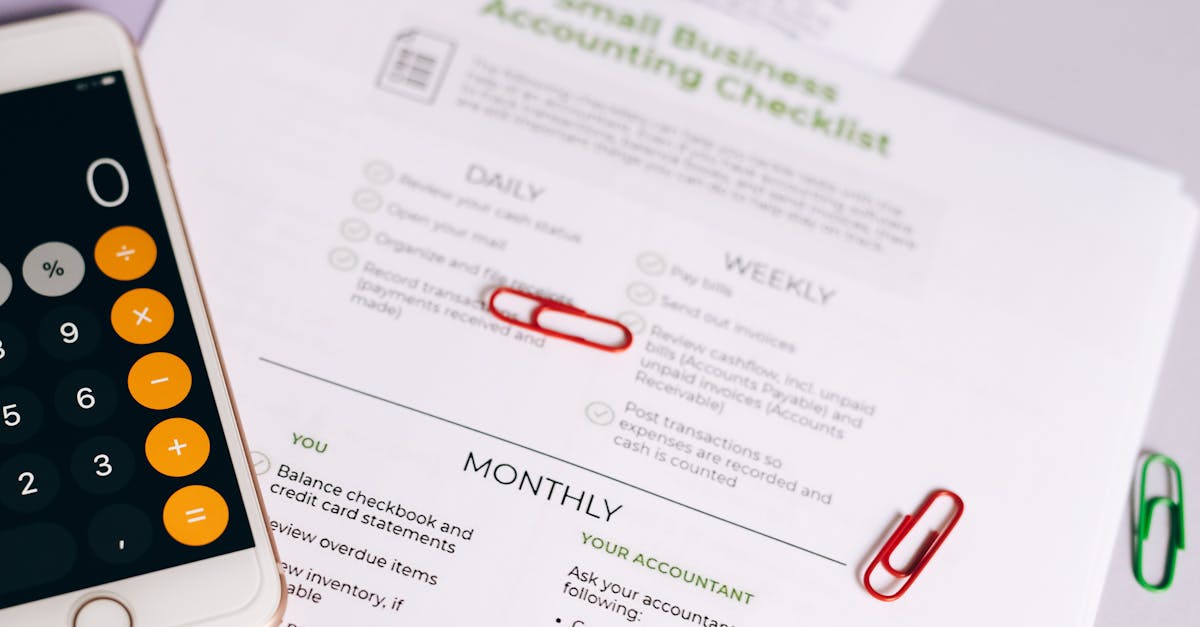

1. Track Your Income and Expenses

One of the fundamental aspects of managing finances and taxes as a home-based worker is keeping a meticulous record of your income and expenses. This not only helps you maintain clarity about your financial health but also proves invaluable come tax season. Utilize digital tools such as accounting software or even a simple spreadsheet to track every dollar that flows in and out.

When you’re organized, tax time becomes less daunting. You can easily provide accurate information when filing your taxes, avoiding errors that may trigger audits. Plus, having a clear financial picture allows you to make informed decisions about your business and personal expenses. It also helps you to see if you are truly making money from home or just spending it.

2. Create a Dedicated Workspace

Establishing a dedicated workspace at home not only boosts your productivity but can also have tax benefits. If you use a specific area solely for work purposes, you may be eligible for a home office deduction. This deduction allows you to write off a portion of your home-related expenses, such as rent, mortgage, utilities, and internet.

However, it’s crucial to adhere to the rules and guidelines set by tax authorities to qualify for this deduction. The space should be exclusively used for work, and you must be able to prove it if required. So, carve out a corner, set up your home office, and potentially reap the tax benefits.

3. Understand Self-Employment Taxes

As a home-based worker, you’re likely considered self-employed, which means you’re responsible for handling your own taxes. Understanding self-employment taxes is crucial to avoid surprises and ensure you’re setting aside the right amount of money throughout the year.

Self-employment taxes cover both Social Security and Medicare, and they can add up quickly. Familiarize yourself with the current tax rates, and consider consulting a tax professional to help you navigate the complexities. By staying informed, you can make quarterly estimated tax payments to avoid a hefty bill come tax season.

4. Embrace Digital Tools

In the digital age, there’s a myriad of tools designed to make your financial management smoother. From accounting software like QuickBooks to expense tracking apps, these tools can help you automate tasks, reduce errors, and gain insights into your financial trends.

Automation not only saves you time but also minimizes the risk of human error. It allows you to focus on what you do best – your work – while ensuring that your financial records are accurate and up-to-date. Explore different tools and find what works best for your workflow.

5. Save for Taxes Regularly

One common pitfall for home-based workers is forgetting to set aside money for taxes regularly. Unlike traditional employees who have taxes withheld from their paychecks, freelancers and self-employed individuals need to be proactive about saving for taxes.

A good rule of thumb is to set aside a percentage of each payment you receive into a separate savings account dedicated to taxes. This way, when tax season arrives, you won’t be scrambling to come up with a lump sum. Consistency is key – make it a habit to allocate a portion of your making money from home income to your tax savings account.

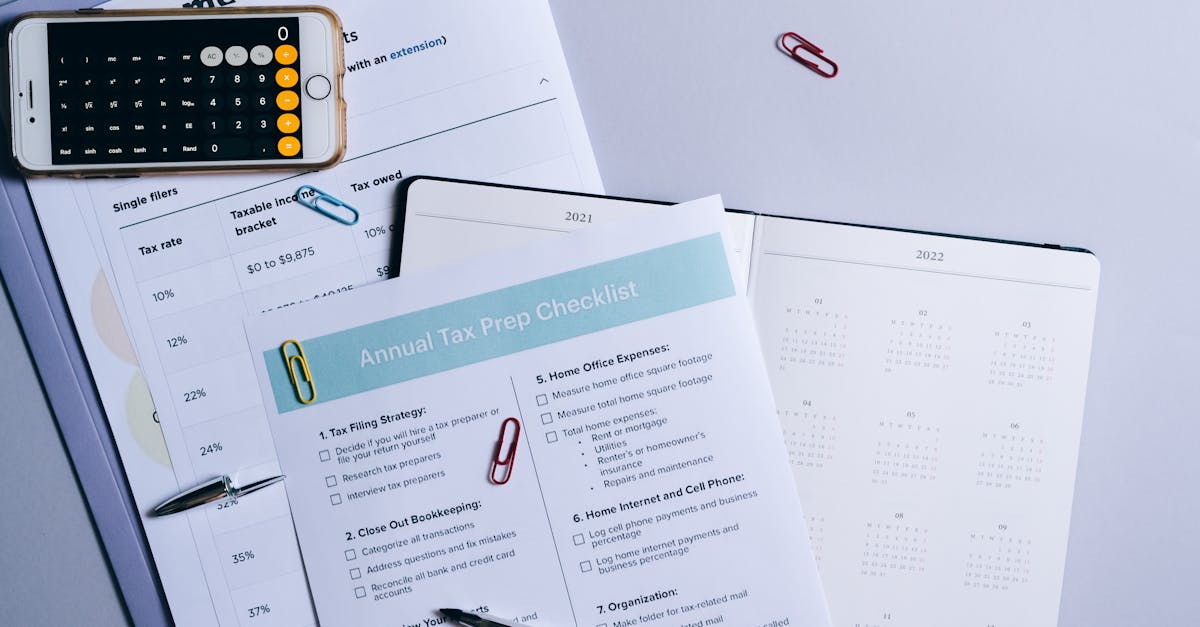

6. Explore Deductions

One of the perks of being self-employed is the potential for deductions that can lower your taxable income. Deductible expenses may include business-related travel, equipment purchases, software subscriptions, and even a portion of your healthcare costs.

Keep detailed records of these expenses, and consult a tax professional to ensure you’re taking advantage of all eligible deductions. Every deduction adds up, helping you keep more of your hard-earned money in your pocket.

7. Consult a Tax Professional

Navigating the intricate landscape of taxes, especially for self-employed individuals, can be challenging. That’s why it’s advisable to consult a tax professional who can provide personalized guidance based on your specific situation.

A tax professional can help you optimize your deductions, ensure compliance with tax laws, and even provide strategic advice for minimizing your tax liability. While there might be a cost associated with hiring a professional, the potential savings and peace of mind are often well worth the investment.

Conclusion

Being a home-based worker making money from home offers a world of flexibility and opportunities, but it also requires a proactive approach to managing finances and taxes. By diligently tracking your income and expenses, understanding self-employment taxes, leveraging digital tools, and exploring deductions, you can navigate the financial landscape with confidence. Remember to save for taxes regularly, create a dedicated workspace for potential deductions, and, when in doubt, consult a tax professional for personalized advice. With a strategic approach, you can not only thrive in your home-based career but also build a solid financial foundation for the future.

Other Managing Finances and Taxes Links to Check out:

Note: This article is for informational purposes only and does not constitute financial or legal advice. Always consult with a professional for specific advice tailored to your situation.