Are you looking for ways to supercharge your retirement savings through tax-advantaged dividend investing? Look no further than Roth IRA dividend strategies! By strategically investing in dividend-paying stocks within a Roth IRA, you can maximize the growth of your retirement nest egg while minimizing your tax liability. In this article, we’ll explore the benefits of Roth IRA dividend strategies and provide helpful tips for making the most of this tax-advantaged investing approach. Get ready to take your retirement savings to the next level!

Table of Contents

- Unlocking the Power of Tax-Free Dividends with Roth IRAs

- Building a Bulletproof Retirement Portfolio with Roth IRA Dividends

- Maximize Your Earnings: The Magic of Compounding in Roth IRAs

- Cherry-Picking Stocks: Dividend Aristocrats and Roth IRAs

- Navigating the Seas of Taxation: Why Roth IRAs are a Harbor for Dividends

- The Early Bird Gets the Worm: Starting Your Roth IRA Dividend Journey

- Reinvesting Dividends in Roth IRAs: A Pathway to Exponential Growth

- Roth IRA Dividend Strategies: Timing Your Contributions for Optimal Growth

- Estate Planning Perks: Passing on Roth IRA Dividends Tax-Free

- From Growth to Income: Transitioning Your Roth IRA Dividend Strategy Over Time

- Questions and Answers For Roth IRA Dividend Strategies, Tax-Advantaged Dividend Investing

- In Conclusion

Unlocking the Power of Tax-Free Dividends with Roth IRAs

When it comes to maximizing your dividend investing strategy, Roth IRAs offer a unique and powerful advantage in the form of tax-free dividends. By harnessing the benefits of Roth IRAs, investors can supercharge their dividend income in a tax-advantaged way, allowing for more growth and compounding over time.

Here’s how you can unlock the power of tax-free dividends with Roth IRAs:

Why Roth IRAs are Ideal for Dividend Investing

- Tax-Free Growth: With a Roth IRA, your investment gains and dividends grow tax-free, meaning you won’t owe taxes on your dividend income as it accumulates.

- Flexibility: Unlike traditional IRAs, Roth IRAs allow you to withdraw your contributions (but not earnings) at any time without penalty, giving you more flexibility with your dividend income.

- No Required Minimum Distributions (RMDs): Roth IRAs are not subject to RMDs during the lifetime of the original owner, allowing you to continue growing your tax-free dividends for as long as you wish.

Step-by-Step Guide to Maximizing Tax-Free Dividends with Roth IRAs

- Contribute to a Roth IRA: Start by contributing to a Roth IRA account. You can contribute up to $6,000 per year, or $7,000 if you’re age 50 or older.

- Select Dividend-Paying Investments: Choose dividend-paying stocks, ETFs, or mutual funds to include in your Roth IRA portfolio. Look for investments with a strong track record of consistent dividend payouts.

- Reinvest Dividends: Consider reinvesting your dividends to purchase additional shares of the dividend-paying investments within your Roth IRA, allowing for compound growth over time.

Recommendations for Tax-Advantaged Dividend Investing

I recommend focusing on high-quality blue-chip dividend stocks and low-cost dividend-focused ETFs or index funds within your Roth IRA to maximize your tax-advantaged dividend income. Companies with a history of increasing dividends over time can be particularly attractive for long-term investors.

Additionally, consider diversifying your dividend investments to reduce risk and maximize your overall dividend income potential. By strategically selecting the right investments within your Roth IRA, you can unlock the power of tax-free dividends and take full advantage of the benefits provided by this powerful investment vehicle.

By implementing these Roth IRA dividend strategies, you can make the most of tax-advantaged dividend investing, allowing you to grow your dividend income in a way that minimizes your tax burden and maximizes your overall investment returns.

Building a Bulletproof Retirement Portfolio with Roth IRA Dividends

When it comes to building a solid retirement portfolio, incorporating Roth IRA dividends can be a savvy strategy for long-term financial success. By focusing on tax-advantaged dividend investing, you can maximize your earnings while minimizing your tax burden.

Here are some key strategies to consider when building a retirement portfolio with Roth IRA dividends :

Leveraging Tax-Advantaged Accounts

One of the most powerful ways to build a retirement portfolio with Roth IRA dividends is by taking advantage of the tax benefits these accounts offer. Unlike traditional IRAs, Roth IRAs allow for tax-free withdrawals in retirement, making them an attractive option for investors seeking to maximize their earnings. By investing in dividend-paying stocks within a Roth IRA, you can enjoy tax-free dividends and potential capital gains, leading to significant long-term growth.

Diversifying Your Dividend Investments

Diversification is key to building a resilient retirement portfolio, and this holds true when investing in Roth IRA dividends as well. By spreading your investments across a range of dividend-paying stocks, ETFs, and mutual funds, you can minimize risk and enhance potential returns. Consider allocating your Roth IRA funds to various sectors and industries to create a well-rounded portfolio that can weather market fluctuations.

Reinvesting Dividends for Compound Growth

Another smart strategy for building a bulletproof retirement portfolio with Roth IRA dividends is to reinvest your dividends for compound growth. Many dividend-paying stocks offer the option to reinvest dividends to purchase additional shares, allowing you to accelerate the growth of your portfolio over time. By harnessing the power of compounding, you can maximize the growth potential of your Roth IRA dividends and enhance your retirement savings.

Seeking Professional Guidance

While implementing these strategies can be highly beneficial, seeking professional guidance from a financial advisor or investment expert is crucial for making informed decisions. A knowledgeable professional can help you navigate the complexities of tax-advantaged dividend investing and tailor a portfolio that aligns with your financial goals and risk tolerance. Consider consulting with a trusted advisor to maximize the effectiveness of your Roth IRA dividend strategies.

In conclusion, requires a thoughtful approach that leverages tax-advantaged accounts, diversifies investments, reinvests dividends for compound growth, and seeks professional guidance. By incorporating these strategies, you can position yourself for long-term financial success and create a resilient retirement nest egg that stands the test of time.

Maximize Your Earnings: The Magic of Compounding in Roth IRAs

When it comes to maximizing your earnings in Roth IRAs, the magic of compounding is a powerful tool that can significantly enhance your investment returns over time. By reinvesting the dividends from your Roth IRA investments, you can take advantage of the snowball effect of compounding, allowing your earnings to generate even more earnings, and so on. This can lead to exponential growth in your retirement savings, helping you achieve your financial goals faster.

With Roth IRA dividend strategies, you can benefit from tax-advantaged dividend investing, allowing you to potentially grow your investments tax-free. By focusing on dividend-paying stocks and funds within your Roth IRA, you can take advantage of the following benefits:

- Tax-Free Growth: Unlike traditional IRAs, Roth IRAs allow your investments to grow tax-free, meaning you won’t owe taxes on dividends or capital gains within the account.

- Compounding Returns: Reinvesting dividends allows you to fully harness the power of compounding, leading to accelerated growth of your retirement savings.

- Stable Income: Dividend-paying investments can provide a steady stream of income, which can be especially beneficial during retirement.

To get started with Roth IRA dividend strategies, consider the following steps:

- Choose Dividend-Paying Investments: Look for stocks, ETFs, or mutual funds that have a history of paying consistent dividends.

- Reinvest Dividends: Set up automatic dividend reinvestment within your Roth IRA to take full advantage of compounding returns.

- Diversify Your Portfolio: Consider diversifying your dividend investments to minimize risk and maximize potential returns.

By implementing these strategies, you can make the most of your Roth IRA and set yourself up for long-term financial success. Remember to consult with a financial advisor or tax professional to ensure that your investment plan aligns with your overall financial goals and tax situation.

Roth IRA dividend strategies offer a compelling way to grow your retirement savings while enjoying tax advantages. By harnessing the power of compounding and focusing on dividend-paying investments, you can set yourself up for financial success in the long run. Start exploring these strategies today and take your retirement savings to the next level.

Cherry-Picking Stocks: Dividend Aristocrats and Roth IRAs

When it comes to building a strong investment portfolio, many investors turn to dividend aristocrats as a reliable source of passive income. These are companies with a proven track record of consistently increasing their dividend payouts over the years, making them a popular choice for long-term investors seeking stability and income.

By incorporating these dividend aristocrats into a Roth IRA, investors can take advantage of the tax benefits offered by these retirement accounts, allowing their dividends to grow and compound tax-free over time.

Benefits of Roth IRA Dividend Strategies:

- Tax-free growth: Unlike traditional retirement accounts, Roth IRAs allow your investments to grow and compound tax-free, including your dividend income.

- Retirement income: By strategically choosing dividend aristocrats for your Roth IRA, you can create a reliable source of income in retirement, supplementing other sources of income such as Social Security and pensions.

- Compound interest: The power of compound interest can work in your favor within a Roth IRA, allowing your dividend income to grow exponentially over time as you reinvest your earnings.

Considerations for Tax-Advantaged Dividend Investing:

- Long-term outlook: Roth IRAs are designed for long-term savings, so it’s important to choose dividend aristocrats with a strong history of consistent dividend growth to maximize the benefits of tax-free compounding.

- Diversification: While dividend aristocrats are known for their stability, it’s still important to diversify your Roth IRA portfolio to mitigate risk and take advantage of opportunities in different sectors or industries.

- Monitoring and adjustments: Regularly review your Roth IRA holdings to ensure that your dividend aristocrats continue to meet your investment criteria and goals. Make adjustments as needed to optimize your portfolio for long-term success.

By integrating dividend aristocrats into a Roth IRA, investors can create a tax-advantaged dividend investing strategy that offers the potential for long-term growth and income. With careful selection and monitoring of dividend-paying stocks, investors can build a diversified portfolio within a Roth IRA that aligns with their retirement goals and financial objectives.

Navigating the Seas of Taxation: Why Roth IRAs are a Harbor for Dividends

When it comes to investing in dividends, finding tax-advantaged options can make a world of difference. One avenue to consider is the Roth IRA, a retirement account that offers unique advantages for dividend investors. Here’s why Roth IRAs are a harbor for dividends:

Tax-Free Growth: Unlike traditional IRAs or 401(k)s, Roth IRAs allow for tax-free growth. This means that any dividends earned within the account are not subject to income tax, allowing your investment to grow exponentially over time.

Tax-Free Withdrawals: Another key benefit of Roth IRAs is the ability to make tax-free withdrawals in retirement. This is especially advantageous for dividend investors, as the dividends earned can be withdrawn without incurring any tax liabilities.

Flexibility: Roth IRAs offer flexibility when it comes to accessing funds. Unlike traditional retirement accounts, Roth IRAs allow for penalty-free withdrawals of contributions at any time, providing a safety net for unexpected expenses without sacrificing the potential growth of your dividends.

Estate Planning Benefits: Roth IRAs also offer attractive benefits for estate planning. Upon your passing, your beneficiaries can inherit the account tax-free, providing a valuable legacy for your loved ones.

Roth IRAs offer a range of benefits for dividend investors, making them a strategic choice for those seeking tax-advantaged dividend investing. With tax-free growth, tax-free withdrawals, flexibility, and estate planning benefits, Roth IRAs provide a harbor for dividends in the stormy seas of taxation.

Whether you’re just entering the world of dividend investing or are a seasoned investor, exploring the potential of Roth IRA dividend strategies is a compelling opportunity to grow your wealth while minimizing tax liabilities.

The Early Bird Gets the Worm: Starting Your Roth IRA Dividend Journey

You’ve decided to start your journey into tax-advantaged dividend investing with a Roth IRA, and that’s a smart move! By prioritizing your retirement savings and harnessing the power of dividend strategies, you’re setting yourself up for long-term financial success.

Here’s how to get started on the right foot.

Understanding Roth IRA Dividend Strategies

When it comes to Roth IRA dividend strategies, the key is to focus on long-term growth while taking advantage of the tax benefits offered by this type of investment account. By investing in dividend-paying stocks or funds within your Roth IRA, you can create a steady stream of income that is not subject to taxation. This means that your dividends can compound over time, maximizing the growth potential of your retirement savings.

Choosing the Right Investments

When selecting investments for your Roth IRA, it’s important to consider a few factors. Look for companies with a history of consistent dividend payments and a track record of steady growth. Additionally, diversifying your portfolio with a mix of different industries and sectors can help mitigate risk and maximize potential returns. Consider investing in dividend-focused ETFs or mutual funds to gain exposure to a wide range of dividend-paying assets.

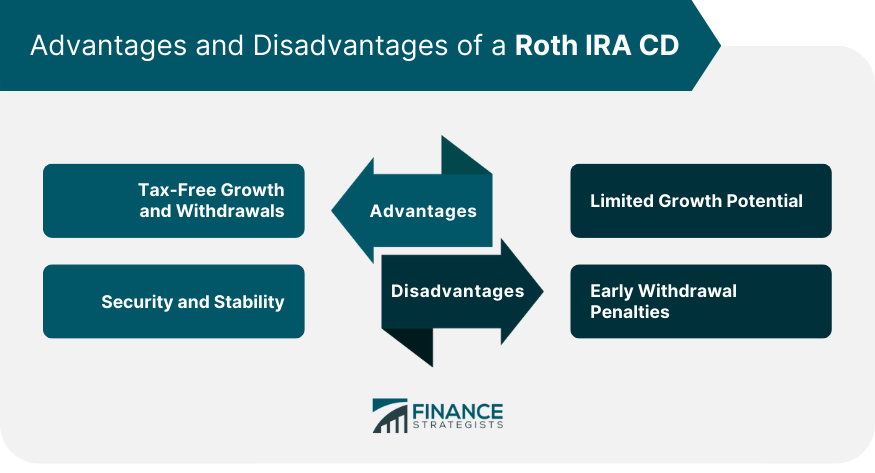

Pros and Cons of Roth IRA Dividend Strategies

One of the major advantages of using a Roth IRA for dividend investing is the tax-free growth and income potential it offers. Additionally, because Roth IRAs have no required minimum distributions during the lifetime of the original owner, you have flexibility in how and when you access your funds in retirement. However, it’s important to keep in mind the contribution limits and income eligibility requirements for Roth IRAs, as well as any potential penalties for early withdrawals.

Getting Started

If you’re ready to start your Roth IRA dividend journey, consider opening an account with a reputable brokerage firm or financial institution. Research and compare different investment options, and seek guidance from a financial advisor if needed. Remember, the early bird gets the worm when it comes to investing for retirement, so don’t wait to take advantage of the tax benefits and growth potential offered by Roth IRA dividend strategies. Happy investing!

Reinvesting Dividends in Roth IRAs: A Pathway to Exponential Growth

Roth IRA dividend strategies offer a tax-advantaged way to invest in dividend-paying stocks, as the earnings generated from these investments grow tax-free. Here’s a step-by-step guide on how to harness the power of reinvesting dividends in Roth IRAs for exponential growth:

Choosing Dividend-Paying Stocks: When selecting stocks for your Roth IRA, look for companies with a history of stable and growing dividends. These are often established companies with a strong track record of profitability and a commitment to returning capital to shareholders.

Reinvesting Dividends: Instead of taking the cash dividends paid out by your investments, consider using them to buy more shares of the same stock. This compounding effect can lead to exponential growth over time, as your dividend income generates additional income.

Setting Up Automatic Reinvestment: Many brokerage firms offer the option to automatically reinvest dividends in your Roth IRA. This hands-off approach allows you to capitalize on the power of compounding without having to monitor and manually reinvest your dividends.

Diversifying Your Portfolio: While focusing on dividend-paying stocks can be lucrative, it’s important to maintain a diverse portfolio to manage risk. Consider including other assets, such as bonds or index funds, to balance out your investments and provide stability.

By incorporating these Roth IRA dividend strategies, you can take advantage of tax-advantaged dividend investing and set yourself on a path to exponential growth. With the power of compounding and a carefully curated portfolio, you can maximize the potential of your Roth IRA and build a strong foundation for your financial future.

Roth IRA Dividend Strategies: Timing Your Contributions for Optimal Growth

So, you’ve decided to explore the world of tax-advantaged dividend investing through Roth IRA. Congratulations! You’re on the right track to securing your financial future. But now comes the question of when to make your contributions for optimal growth. Let’s dive into some strategies to help you make the most of your Roth IRA dividend investments.

Regular Monthly Contributions

Consider making regular monthly contributions to your Roth IRA. By committing to a set amount each month, you’ll benefit from dollar-cost averaging. This strategy allows you to buy more shares when prices are low and fewer shares when prices are high, ultimately smoothing out the cost of your investments over time.

Front-loading Contributions

Front-loading involves making your full annual contribution at the beginning of the year instead of spreading it out over twelve months. This strategy can be advantageous if you expect the stock market to rise over the year, as it allows your investments to potentially grow tax-free for a longer period.

Consider Market Conditions

Take market conditions into account when timing your contributions. If you believe the market is overvalued, you may want to hold off on making a large contribution. Conversely, if you think stocks are undervalued, it could be a good time to take advantage of lower prices.

Automate Your Contributions

Consider setting up automatic contributions to your Roth IRA. This removes the need to remember to make contributions each month and ensures that you’re consistently adding to your investments. Plus, automating your contributions can help you avoid the temptation to spend the money elsewhere.

By understanding these Roth IRA dividend strategies, tax-advantaged dividend investing can become a powerful tool for building wealth over the long term. Take the time to consider your individual financial situation and goals to implement the strategy that best fits your needs.

Estate Planning Perks: Passing on Roth IRA Dividends Tax-Free

When it comes to estate planning, passing on Roth IRA dividends tax-free is a significant perk that many people overlook. This strategy can provide long-term financial benefits for your heirs, ensuring that they receive the full value of your Roth IRA investment without being burdened by taxes. By understanding the ins and outs of Roth IRA dividend strategies, you can effectively utilize tax-advantaged dividend investing to secure a brighter future for your loved ones.

One of the primary advantages of passing on Roth IRA dividends tax-free is the potential for tax-free growth over time. Unlike traditional IRAs, Roth IRAs allow your investments to grow tax-free, meaning that any dividends earned on your investments are not subject to income tax. This can significantly increase the value of your IRA over the years, providing a substantial financial legacy for your beneficiaries.

Another benefit of passing on Roth IRA dividends tax-free is the flexibility it offers to your heirs. Unlike traditional IRAs, which require beneficiaries to take mandatory distributions and pay income tax on the withdrawals, Roth IRA dividends can be passed on tax-free, allowing your heirs to maintain the tax-advantaged status of the account and continue to benefit from tax-free growth.

In addition to the tax advantages of passing on Roth IRA dividends tax-free, this strategy can also provide a sense of security and peace of mind for your beneficiaries. Knowing that they will receive the full value of your Roth IRA investment, without the burden of taxes, can alleviate financial stress and provide a solid foundation for their future financial success.

With careful estate planning and a clear understanding of Roth IRA dividend strategies, you can ensure that your loved ones are well taken care of for years to come.

From Growth to Income: Transitioning Your Roth IRA Dividend Strategy Over Time

As your Roth IRA grows, you may find that your investment goals shift from seeking growth to generating income. When this transition occurs, it’s important to adjust your dividend strategy to maximize the benefits of tax-advantaged dividend investing.

Here are some steps to consider as you make this transition:

Evaluating Your Current Portfolio

- Take stock of your current holdings and assess which assets are generating the most dividends.

- Consider the overall performance of your portfolio and identify areas where you may want to reallocate funds for income-generating investments.

Shifting Focus to Income

- Look for dividend-paying stocks or funds with a track record of consistent and growing dividends.

- Consider adding high-yield dividend stocks or funds to your portfolio to increase your income stream.

Rebalancing Your Portfolio

- As you shift your focus to income, you may need to rebalance your portfolio to ensure you have the right mix of growth and income-generating assets.

- Consider selling off some of your growth-oriented investments and reinvesting the proceeds into dividend-paying assets.

Monitoring and Adjusting

- Keep a close eye on the performance of your income-generating investments and make adjustments as needed.

- Regularly review your portfolio to ensure it continues to align with your changing investment goals.

By following these steps and transitioning your Roth IRA dividend strategy over time, you can make the most of tax-advantaged dividend investing and ensure that your investment portfolio continues to meet your needs as they evolve.

Questions and Answers For Using a Roth IRA for Dividend Investing

What is a Roth IRA dividend strategy?

A Roth IRA dividend strategy involves investing in dividend-paying stocks within a Roth IRA account to maximize tax-free retirement income.

How does tax-advantaged dividend investing work?

Tax-advantaged dividend investing involves utilizing accounts like Roth IRAs to invest in dividend-paying stocks, allowing for tax-free growth and withdrawals in retirement.

Why should I consider using a Roth IRA for dividend investing?

Using a Roth IRA for dividend investing can provide tax-free income in retirement, as well as potential for long-term investment growth.

What types of investments can I hold in a Roth IRA for dividend strategies?

You can hold a variety of investments in a Roth IRA for dividend strategies, such as individual dividend-paying stocks, dividend-focused ETFs, and dividend mutual funds.

Are there any limitations to using a Roth IRA for dividend investing?

While Roth IRAs offer tax advantages, there are contribution limits and income restrictions for eligibility, so it’s important to be aware of these limitations.

How do I start implementing a dividend strategy within my Roth IRA?

You can start implementing a dividend strategy within your Roth IRA by opening an account, funding it with contributions, and selecting dividend-focused investments.

What are the tax implications of dividend investing in a Roth IRA?

Dividends earned within a Roth IRA are typically tax-free, allowing for tax-advantaged growth and income in retirement.

What are some tips for maximizing dividends within a Roth IRA?

Consider reinvesting dividends, diversifying your dividend investments, and regularly reviewing and adjusting your portfolio to maximize dividend income within a Roth IRA.

How can I diversify my dividend portfolio within a Roth IRA?

You can diversify your dividend portfolio within a Roth IRA by investing in a mix of different types of dividend-paying stocks and funds across various sectors.

Are there any potential risks associated with dividend investing in a Roth IRA?

As with any investment strategy, there are potential risks, such as market volatility and fluctuations in dividend payments, so it’s important to carefully consider your risk tolerance and investment goals.

In Conclusion

So there you have it – a deeper dive into the world of Roth IRA dividend strategies and tax-advantaged dividend investing. Hopefully, you’ve gained some valuable insights and ideas on how you can maximize your investment returns while minimizing your tax liabilities. Remember, it’s always a good idea to consult with a financial advisor or tax professional before implementing any new investment strategies. With careful planning and wise decision-making, you can make the most of your Roth IRA and set yourself up for a secure financial future. Happy investing!